Welcome to Germany! Before you get lost in the delights of bratwurst and biergartens, there's one essential task you need to tackle right away: sorting out your health insurance. It's a legal requirement for every single resident, expats included, from the very first day you arrive. Honestly, there is no grace period, making this the most critical piece of admin for your new life in Germany.

Why Health Insurance in Germany Is Non-Negotiable

Moving to Germany is about more than just finding a great flat and registering your address. The German government puts a huge emphasis on social welfare and universal access to healthcare. This isn't just a friendly suggestion—it’s a legal obligation that you absolutely must meet to secure your residence permit.

Think of the German healthcare system as having two main doors you can walk through. It’s a “dual system,” and getting your head around it is the first real step to choosing the right plan. The two pillars are:

- Public Health Insurance (GKV): Officially known as Gesetzliche Krankenversicherung, this is the state-regulated system that the vast majority of people in Germany use.

- Private Health Insurance (PKV): This is the Private Krankenversicherung, an alternative path mostly for high-income earners, freelancers, and certain civil servants.

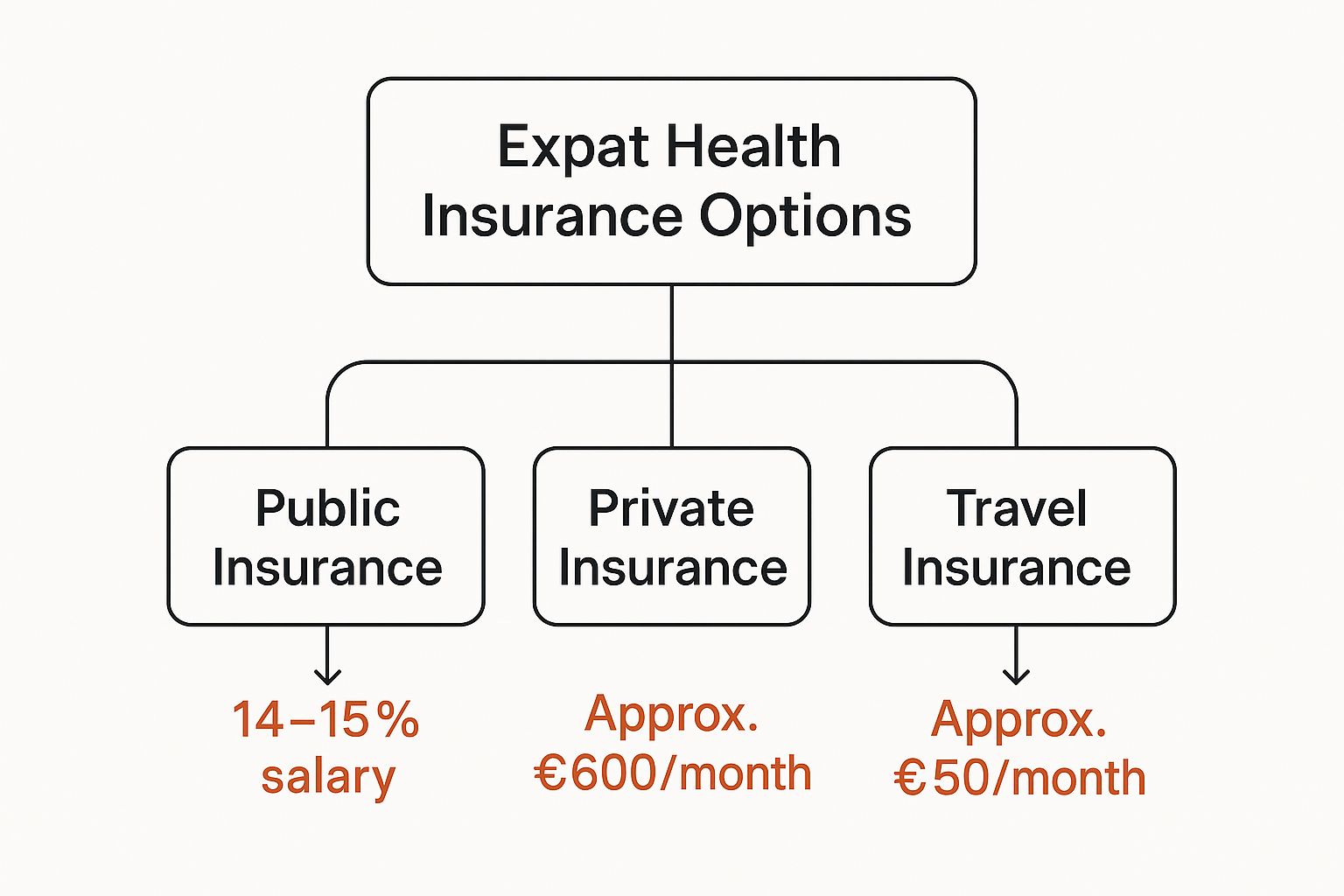

The image below gives a nice visual breakdown of the main insurance options for expats and how their costs generally work.

As you can see, public insurance contributions are linked to your salary. Private plans, on the other hand, have fixed premiums, while temporary travel insurance can act as a more budget-friendly bridge when you first arrive.

Understanding Germany's Dual System

This dual-system approach is the foundation of expat health insurance in Germany. It's designed to provide a solid safety net for everyone, while also offering flexibility for those who qualify for—and prefer—a different kind of care. A staggering 88% of Germany's population is covered by the public GKV system, which really shows its role as the standard choice for most people. In contrast, around 11% of residents opt for private PKV insurance. If you're curious about the numbers, you can find more German health insurance statistics on kummuni.com.

To give you a clearer picture, here's a quick comparison of the two systems.

Quick Look at GKV vs PKV for Expats

| Feature | Public Health Insurance (GKV) | Private Health Insurance (PKV) |

|---|---|---|

| Eligibility | Open to almost everyone, mandatory for employees under a certain income threshold. | Primarily for high-income earners, freelancers, and civil servants. |

| Cost Basis | Percentage of your gross income, with a cap. | Based on your age, health status at entry, and chosen plan level. |

| Family Coverage | Non-working dependants (spouse, children) are typically covered for free. | Each family member needs their own separate policy and premium. |

| Choice of Doctor | Limited to doctors who accept GKV patients (most do). | Freedom to choose any doctor or specialist, including private ones. |

This table simplifies things, but the core takeaway is that your income and job are the biggest factors deciding which system you can join. For most expats arriving for a new job, the decision is often made for you, at least to start.

Your employment status and income are the main factors that determine which system you're eligible for. For most employees, the choice is pretty much made for you, at least initially.

For newcomers, this all means you can't just put off health insurance until you feel unwell. You will need to provide proof of continuous health coverage (a document called the Versicherungsnachweis) for any visa or residence permit application. Failing to have this sorted will bring your relocation process to a grinding halt and could even lead to hefty back payments.

Don't worry, though. This guide is here to walk you through making this crucial decision with confidence.

Exploring Public Health Insurance (GKV)

For most expats setting up a new life in Germany, the Public Health Insurance system, known as Gesetzliche Krankenversicherung (GKV), is where you'll start. It's the backbone of the country's healthcare, covering about 90% of the population.

The GKV system is built on a foundational principle of solidarity. This isn't like commercial insurance where your age or pre-existing conditions dictate your price. Instead, everyone pays a percentage of their gross income (up to a limit), meaning high earners contribute more than lower earners for the very same high-quality care. It's a system designed to keep healthcare accessible for all.

Who Qualifies for GKV?

Your path into the public system is usually determined by your job and how much you earn. For most expats, the rules are pretty straightforward.

If you’re an employee earning less than the annual income threshold, or Jahresarbeitsentgeltgrenze, you are legally required to join the GKV. For 2024, this threshold is set at €69,300 per year. Earn less than this, and you’ll be automatically enrolled in a public plan.

Even if you earn more, you can still opt to stay in the public system. It’s also the go-to choice for most university students under 30.

The core idea behind GKV is solidarity, not individual risk. Your contribution is tied to your ability to pay (your income), ensuring that everyone, regardless of their health status or family size, receives the same fundamental level of care.

The Power of Family Co-Insurance

One of the most incredible benefits of the GKV, especially for families, is the family co-insurance policy, or Familienversicherung. For many newcomers, this feature is a total game-changer.

If you're a paying member of a public fund, you can add your non-working spouse and dependent children to your plan at absolutely no extra cost. They get their own insurance cards and full access to the same medical services you do, all without your monthly payment going up a single cent. This can lead to massive savings compared to private insurance, where every family member needs their own individual—and expensive—policy.

Understanding Your Coverage and Contributions

While all public funds are state-regulated and must offer a standard set of legally required services, they aren't all exactly the same. There are over 90 different public health insurance providers (Krankenkassen) to pick from, like the well-known TK, AOK, or Barmer.

The basic contribution is a fixed percentage of your gross income, which you and your employer split down the middle. But on top of that, each Krankenkasse can charge a small additional contribution (Zusatzbeitrag). This is how they compete, often using that extra fee to fund bonus services and perks.

Here's a look at what your standard GKV coverage will always include:

- Doctor and Specialist Visits: Complete coverage for appointments with doctors registered within the GKV system.

- Hospital Care: All necessary in-patient treatment in public hospitals, typically in a shared room.

- Prescription Medications: Most drugs are covered, though you’ll usually have a small co-payment of around €5-€10.

- Basic Dental Care: This covers your regular check-ups and standard procedures like fillings.

- Preventative Screenings: A wide variety of health check-ups and preventative care is fully covered.

It can be smart to pick a Krankenkasse with a slightly higher additional contribution if they offer perks you'll actually use, such as professional dental cleanings, travel vaccinations, or osteopathy. When you're choosing, it’s worth comparing these extras to find the best expat health insurance Germany has for your specific needs, allowing you to tailor your plan without ever leaving the public system.

Understanding Private Health Insurance (PKV)

While the public system (GKV) is the bedrock of German healthcare, it’s not the only option. For certain groups, there's an alternative path: Private Health Insurance, known locally as Private Krankenversicherung (PKV). Think of it as a premium, à la carte version of health coverage. If you're a high-income earner, a freelancer, or self-employed, the PKV system might be on your radar.

Unlike the GKV, where your payments are tied to your income, PKV works very differently. It’s much more like the insurance you might be used to back home, where your premium is a personalised price based on your individual risk profile. In other words, the insurer calculates a monthly cost just for you.

Who Is Eligible for Private Health Insurance?

Getting into the private system isn't a free-for-all; German regulations are quite specific about who qualifies. You can generally opt for private insurance if you fall into one of these categories:

- You're an employee earning above the income threshold: This magic number, the Jahresarbeitsentgeltgrenze, is set at €69,300 per year for 2024. Earn more than this, and you’re free to leave the GKV and shop for a private plan.

- You're self-employed or a freelancer: If you run your own show, you can apply for PKV right away, no matter how much you earn.

- You're a civil servant (Beamte) or a student over 30: Special rules also give these groups a direct entry pass into the private system.

For many expats, especially those in the groups above, PKV can seem very attractive. It often promises a higher tier of medical care and can even be cheaper, particularly if you're young and in good health.

Weighing the Pros and Cons of PKV

Choosing between public and private insurance is one of the most significant financial decisions you'll make in Germany. It has long-term implications, so you need to look at it from all angles. The customisation of PKV brings some fantastic perks, but it also comes with some serious drawbacks.

On the plus side, the level of care is often seen as superior. Private patients typically get:

- Quicker appointments with specialists.

- Treatment from senior physicians or chief hospital doctors (Chefarztbehandlung).

- The comfort of a private or semi-private hospital room.

- Broader coverage for things like extensive dental work, alternative medicine, and glasses or contact lenses.

But what about the downsides? They can be significant. The biggest issue is that premiums are not fixed for life. They will almost certainly rise as you age. On top of that, every single family member needs their own policy. This can quickly become a massive financial burden for families, unlike the GKV where non-working spouses and children are often covered for free.

One thing you absolutely must understand is this: once you go private, getting back into the public GKV system is incredibly difficult, and for most people, it's impossible. This decision is a long-term commitment that will follow you well into retirement.

How PKV Premiums Are Calculated

Your monthly PKV premium isn't a standard fee; it's a highly personalised number. Insurers look at a few key factors to figure out what you'll pay:

- Your Age at Entry: The younger you are when you sign up, the lower your starting premium will be. This is a huge factor.

- Your Health Status: You'll have to go through a health check (Gesundheitsprüfung). Any pre-existing conditions can result in higher premiums, special clauses, or even an outright rejection from the insurer.

- Your Desired Level of Coverage: This is where you get to customise. A basic plan is obviously cheaper than an all-inclusive one with top-tier dental benefits and a private hospital room guarantee.

- Your Chosen Deductible (Selbstbeteiligung): You can agree to pay a certain amount of your medical costs yourself each year. A higher deductible means a lower monthly premium.

This bespoke approach is at the heart of the expat health insurance Germany dilemma. A young, healthy, single freelancer might find that a PKV plan costs less than GKV while offering far more. But for someone older, or a family with kids, the rising costs and individual policies often make the GKV the safer, more predictable bet for the long haul.

Breaking Down the Costs of German Health Insurance

Alright, let's talk numbers. Getting a handle on the financial side of your expat health insurance Germany plan is crucial for budgeting and making a smart choice. The way costs are calculated for public (GKV) and private (PKV) insurance couldn't be more different, and your personal situation will determine which path makes more financial sense.

How Public Insurance (GKV) Costs Are Calculated

With public insurance, your cost has nothing to do with your health and everything to do with your income. The system works on a fixed percentage of your gross salary, a cost that’s split right down the middle between you and your employer. This makes budgeting wonderfully predictable.

For 2024, the general contribution rate is 14.6% of your gross monthly income. Your employer pays half (7.3%), and the other half comes out of your paycheque. Simple.

But there’s one more small piece to the puzzle: an "additional contribution" called the Zusatzbeitrag. This small extra percentage, which averages around 1.7%, also gets split with your employer. It’s the main way public funds compete, with some offering slightly better perks for a slightly higher fee. It’s worth noting these costs have been creeping up; statutory health insurance prices have risen significantly in the last 50 years, and you can see a clear upward trend in this additional contribution. For a deeper dive into these rising rates, Germany-Visa.org provides a detailed overview.

In short, GKV costs are a straightforward percentage of your salary, up to a certain income cap. Your age, health history, or how many kids you have don’t factor into the equation at all.

How Private Insurance (PKV) Premiums Are Determined

Private insurance flips that logic completely on its head. Here, your income doesn't matter one bit. Instead, your premium is a highly personalised price based entirely on your individual risk profile.

The main ingredients that go into your monthly PKV premium are:

- Your Age: The younger you are when you sign up, the lower your starting premium will be for life.

- Your Health: Expect a thorough health check. Any pre-existing conditions can lead to much higher costs or, in some cases, even make you ineligible.

- Your Chosen Tariff: A basic plan is obviously much cheaper than a premium package that includes things like a private hospital room or extensive dental coverage.

- Your Deductible (Selbstbeteiligung): This is the amount you agree to pay out-of-pocket each year before your insurance starts covering the bills. Picking a higher deductible directly lowers your monthly premium.

This custom-built approach means that a young, healthy freelancer could easily find a PKV plan that's not only cheaper but also offers more extensive coverage than the public system.

A Tale of Two Expats: A Cost Comparison

To see how this plays out in the real world, let's look at how the numbers stack up for a couple of common expat scenarios. The figures here are estimates, but they do a great job of showing just how different the financial outcomes can be.

Monthly Cost Estimate GKV vs PKV

The table below gives a snapshot of potential monthly premiums for different expat profiles, illustrating how your circumstances heavily influence which system is more cost-effective.

| Expat Profile | Estimated GKV Monthly Premium | Estimated PKV Monthly Premium |

|---|---|---|

| Single Professional, Age 30, €75,000 Salary | Approx. €420 | Starts around €350 – €450 |

| Family of Four, Age 40, €80,000 Salary | Approx. €430 (family is co-insured for free) | €1,200+ (each family member needs a policy) |

As you can see, the private route looks very attractive for the single professional. For the family, however, the GKV’s ability to co-insure dependants for free makes it the clear winner from a cost perspective. This single factor is often the most critical consideration for expats with families.

How to Enrol in German Health Insurance

Right, now that you’ve got a handle on the differences between public and private insurance, it's time to get you signed up. This is your practical, step-by-step roadmap for enrolling in the German health insurance system.

The journey looks a bit different depending on whether you go public (GKV) or private (PKV), but a little preparation goes a long way for both.

Your Essential Document Checklist

Before you do anything else, get your documents in order. Trust me, having everything ready from the start will save you a world of frustration and delays down the line. It's the first and most critical step.

You'll almost certainly need these for any application:

- A valid passport

- Proof of residence registration (Anmeldebestätigung): This is the official paper you get from the local citizens' office (Bürgeramt) once you've registered your address.

- Your employment contract or proof of freelance work: This is crucial, as it often determines whether you're eligible for public or private insurance.

- German bank account details: Your insurance contributions will be paid directly from a German account.

- A passport-sized photo for your health insurance card.

Sorting these documents isn't just for your health insurance; many are also essential for getting your work visa. For a complete rundown, you can learn more about German work visa requirements in our detailed article.

The GKV Enrolment Process for Employees

For most employees, joining a public health fund (Krankenkasse) is refreshingly simple. Your employer is actually a key part of the process, which helps smooth things over considerably.

Here’s how it usually works:

- Choose Your Provider: Your employer will ask you which public provider you want to join (like TK, AOK, or Barmer). You can pick one based on their extra services or their additional contribution rate (Zusatzbeitrag).

- Complete the Application: You’ll fill out a membership form, which is almost always available online and often in English.

- Inform Your Employer: Once you get your membership certificate (Mitgliedsbescheinigung), just hand it over to your HR department.

- Automatic Deductions: That’s it on your end. Your employer takes care of registering you with the social security system, and your contributions are automatically taken from your monthly salary.

- Receive Your Card: In a few weeks, your health insurance card (Gesundheitskarte) will show up in the mail. You're officially covered.

The real beauty of the GKV process for employees is how seamlessly it’s built into your job. Your HR department acts as a partner, cutting through the red tape and making sure you’re properly insured from day one.

The PKV Enrolment and Approval Steps

Going with private insurance is a much more hands-on affair. Because your premiums are calculated based on your personal health risk, the application process is far more detailed.

The core of the application is a health questionnaire (Gesundheitsprüfung). Here, you have to disclose every single pre-existing condition you have. Absolute honesty is critical—any fibs or omissions could invalidate your policy later on.

Based on your answers, the insurer will put together a specific plan and price for you. Once you accept their offer, you’ll get a confirmation of coverage (Versicherungsbescheinigung), which is the vital document you need for your visa or residence permit.

If you’re an employee choosing private insurance, you also need to get an employer certificate (Arbeitgeberbescheinigung) to make sure your company pays its share. Unlike the public system, you'll pay the entire premium to the insurer yourself each month, and your employer will reimburse their portion along with your salary.

Common Mistakes Expats Make with Health Insurance

Navigating German health insurance is a rite of passage for every expat, but it's a path riddled with potential traps. A few common missteps can quickly turn this administrative step into a huge source of stress and financial pain. The best way forward is to learn from the mistakes others have made, so you can secure the right cover from day one.

One of the most frequent errors I see is people not taking the health check (Gesundheitsprüfung) for private insurance (PKV) seriously enough. It’s easy to treat it like a simple form, forgetting to mention minor past conditions or treatments. This is a massive mistake. German insurers are incredibly thorough, and any non-disclosure can lead to premium hikes, refusal to cover that specific condition, or even having your entire policy cancelled just when you need it most.

Another classic blunder is arriving in Germany with only travel insurance, thinking it will tide you over. Let me be clear: a standard travel policy is not a substitute for proper German health insurance. It won't be accepted for your residence permit, and it's only designed for short-term emergencies, not the comprehensive, long-term cover the law demands.

The Long-Term PKV Commitment

For young, healthy expats, private insurance can look very attractive at first glance. The initial monthly premium is often lower than the public system (GKV), making it seem like the obvious financial win. But this narrow focus on short-term savings completely misses the bigger picture.

Choosing private insurance is a serious long-term commitment, and one that's nearly impossible to undo. Those low premiums don't stay low forever; they are designed to increase as you get older. What feels perfectly affordable in your 30s can balloon into a significant financial burden in your 50s and 60s, a stage in life when your income might not be at its peak.

A critical mistake is failing to understand that choosing PKV is a decision that significantly impacts your retirement. Switching back to the GKV system after the age of 55 is legally barred for almost everyone, locking you into potentially high private insurance costs for the rest of your life.

This commitment also extends to your family. Unlike the public system, which offers free co-insurance for dependants, every member of your family needs their own separate—and often costly—private policy.

Misinterpreting Key Benefits and Rules

The German system has its own unique logic, with rules that can easily trip up newcomers. A perfect example is the 'family co-insurance' (Familienversicherung) in the public system. Many expats assume it’s a blanket benefit, but it comes with strict conditions. For instance, if your spouse earns over a certain low-income threshold, they won’t qualify for free cover and will need their own plan.

Other common slip-ups include:

- Not Comparing Providers: Simply signing up with the first health fund (Krankenkasse) your employer mentions is a missed opportunity. You could be passing up better bonus services—like professional dental cleanings or travel vaccinations—offered by competitors for the exact same price.

- Ignoring the Deductible: When selecting a private plan, it's tempting to choose a very high deductible (Selbstbeteiligung) to bring down the monthly premium. This can backfire spectacularly if you're suddenly hit with unexpected medical bills.

Getting these details right requires clear, personalised advice. If you're looking for guidance tailored to your own relocation and career path, you can get expert help by exploring https://www.iknowly.com/faq/consultee/Getting_Started_with_iKnowly/What_is_iKnowly_and_how_does_it_work. Making the right choice from the beginning ensures your expat health insurance Germany becomes a source of security, not a future headache.

Frequently Asked Questions

When you're trying to get your head around the German healthcare system, a few key questions always seem to pop up. Let's tackle some of the most common ones to help clear up any lingering confusion about expat health insurance Germany.

Are Pre-Existing Conditions Covered?

This is a huge one, and it's where the two systems really show their differences.

- Public Health Insurance (GKV): Yes, without a doubt. The law requires public funds to accept you regardless of your medical history. They can't charge you more or refuse to cover your pre-existing conditions.

- Private Health Insurance (PKV): This is where it gets tricky. Private insurers can, and often do, increase your premiums based on your health. They might also write specific exclusion clauses into your contract or, in some cases, deny your application altogether.

A word of advice for anyone considering private insurance: be completely upfront during the health check, known as the Gesundheitsprüfung. If you try to hide a condition, they could void your policy later on, leaving you with no coverage at all.

Does My Insurance Cover My Family?

This is a major factor that can swing your decision, especially from a financial perspective. The public system offers a fantastic benefit for families called Familienversicherung. This allows you to add your non-working spouse and children to your plan for free.

Private insurance, on the other hand, works very differently. Every single person needs their own policy. That means you'll pay a separate monthly premium for your partner and for each child, right from birth. For families, this can make the private option far more expensive than it first appears.

Can I Find an English-Speaking Doctor?

Yes, absolutely. You won't have much trouble finding doctors who speak excellent English, particularly in Germany's bigger cities. The healthcare system is well-equipped to handle the international community.

Here are a few ways to find one:

- Start by asking your insurance company. They usually have a list of local, English-speaking doctors and specialists.

- Check out online portals that are specifically designed to help you filter doctors by language.

- Don't underestimate the power of community. Ask for recommendations in local expat forums or social media groups.

For those looking for professional guidance beyond healthcare, such as navigating a career change in Germany, our article on how to become a consultant on iKnowly provides some excellent starting points.

Moving to Germany involves juggling many moving parts, from visas to finding your professional footing. iknowly connects you with verified German professionals for 1:1 video consultations. Whether you need help with your visa application, a CV check, or career advice, you can get personalised guidance from experts at top companies by visiting https://www.iknowly.com.

Leave a Reply