So, what does it really cost to live in Germany? The short answer is that a single person can expect to spend around €1,900 per month, while a family of four might need upwards of €4,200, rent included. But that's just a ballpark figure.

Think of it like this: planning your budget for Germany is a bit like planning a road trip. The final cost depends entirely on your destination and the kind of journey you want. The national averages give you a great starting map, but your personal financial path will be shaped by the city you call home and your day-to-day choices. A well-thought-out budget isn't just about getting by; it’s your best tool for building a comfortable life here.

A Closer Look at German Living Expenses

It's no secret that inflation has been felt across the board. The Federal Statistics Office reported that in 2022, an average household's monthly spending was about €2,846. The biggest chunks of that were housing and utilities at €1,025, food at €417, and transport at €347. To live comfortably now, it's wise to aim for a household budget closer to €3,154 per month. For a deeper dive, you can explore more about these German household expense trends from Expatica.

To give you a clearer picture, let's break down what a typical month might look like. You can use this as a starting point and tweak it to fit your own situation.

Key Takeaway: While Germany is often more affordable than many of its Western European neighbours, the city you choose is the single biggest factor influencing your budget. Your expenses in Munich will look very different from those in Leipzig.

Average Monthly Expenses in Germany

Here’s a general overview of what a single person might expect to spend each month. This table summarises the typical costs, giving you a solid baseline for your own financial planning.

| Expense Category | Estimated Monthly Cost |

|---|---|

| Rent (1-bedroom apartment) | €700 – €1,200 |

| Utilities (incl. internet) | €250 – €400 |

| Groceries | €200 – €400 |

| Public Transport | €49 – €90 |

| Health Insurance (public) | ~€120 (student rate) |

| Leisure & Entertainment | €150 – €300 |

| Total Estimated Range | €1,469 – €2,510 |

Keep in mind, this is just a foundational guide. As we continue, we’ll dive deeper into each of these categories, exploring how costs vary and where you can find smart ways to save.

Why Your City Choice Matters Most

When you’re planning a budget for Germany, it’s a mistake to think of the country as a single financial landscape. It’s more like a mosaic of different regions, each with its own economic personality. Honestly, where you decide to live is the single biggest factor that will shape your cost of living. The financial gulf between a buzzing southern hub and a charming eastern city can be absolutely massive.

This isn't just about rent, either. This regional difference trickles down into everything, from the price of your monthly transport ticket to what you’ll pay for your morning coffee. Your choice of city sets the entire financial stage for your life in Germany and determines just how far each euro will actually go.

The Great North-South Divide

As a general rule of thumb, life in the southern and western states (Bundesländer) tends to be quite a bit more expensive than in the northern and eastern regions. Why? It mostly comes down to economic muscle. The south is packed with Germany's industrial and financial powerhouses, and that concentration of wealth drives up prices.

For instance, cities in Bavaria and Baden-Württemberg, like Munich and Stuttgart, consistently rank as Germany's priciest places to live. They offer fantastic job markets and high salaries, but you'll pay a premium for housing and daily expenses. On the flip side, cities in states like Saxony or Brandenburg offer a much more accessible cost of living.

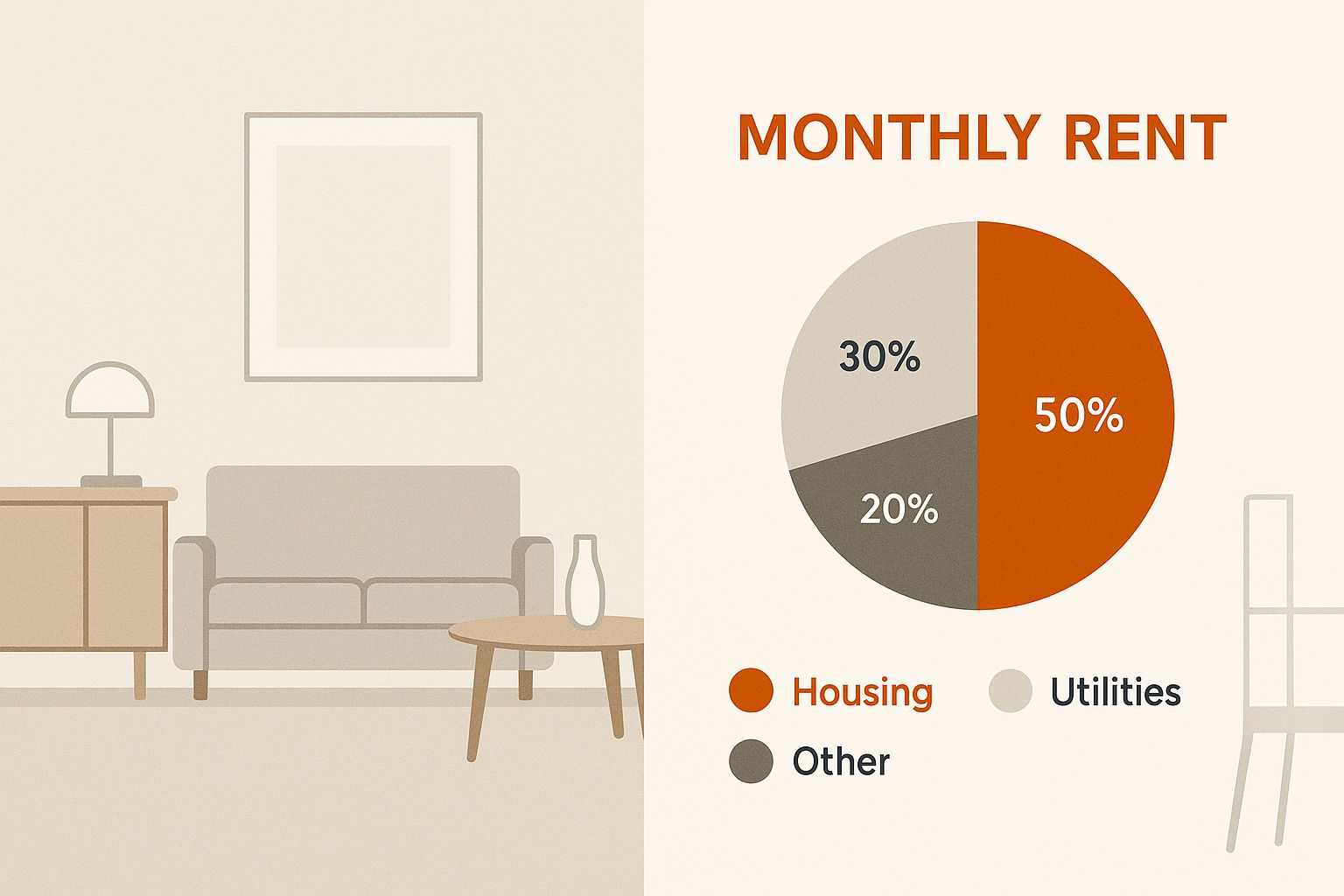

This image really drives home the difference in monthly rental costs, which is usually the biggest slice of anyone's budget.

As you can see, finding a flat in a high-demand city can easily chew up a much larger chunk of your salary compared to more affordable parts of the country.

Major Hubs Versus Affordable Alternatives

Let’s put some real numbers to this. Your total monthly expenses can swing wildly, from around €1,000 to €3,000, depending almost entirely on your post code. Cities like Munich and Stuttgart are notorious for their high price tags. Even Berlin, once famous for being a cheap capital, has seen its rental market explode. A standard 60m² apartment there now runs between €1,300 and €1,600—often costing more than in Düsseldorf or Hamburg.

This sharp contrast shows just how critical it is to do your homework before you pack your bags for a specific city.

Key Insight: Don't just follow the crowds to the biggest name cities. A mid-sized city like Leipzig or Dresden might offer 90% of the lifestyle perks of Berlin or Hamburg, but at 60% of the cost. That's a huge difference that can give you much more financial breathing room.

Cost of Living Comparison Across German Cities

To really illustrate this point, let's compare some of the most popular destinations for expats. This table gives a quick snapshot of what you can expect to pay for two of the biggest monthly costs—rent and public transport—in different German cities.

| City | Average Rent (85m² Furnished) | Monthly Transport Pass |

|---|---|---|

| Munich | €2,200 – €2,600 | €60 – €70 |

| Berlin | €1,800 – €2,200 | €49 (Deutschlandticket) |

| Hamburg | €1,700 – €2,100 | €49 (Deutschlandticket) |

| Frankfurt | €1,600 – €2,000 | €49 (Deutschlandticket) |

| Stuttgart | €1,500 – €1,900 | €49 (Deutschlandticket) |

| Leipzig | €1,000 – €1,400 | €49 (Deutschlandticket) |

| Dresden | €900 – €1,300 | €49 (Deutschlandticket) |

As the numbers show, choosing a city like Leipzig or Dresden over Munich could save you over €1,000 every single month on rent alone. While the Deutschlandticket has standardised transport costs in many places, the housing market remains the biggest variable.

A Tale of Two Cities: A Cost Comparison

To truly grasp the difference, let’s look at two popular cities that offer very different experiences.

-

Munich (The Expensive Hub): As Bavaria’s capital, Munich is an economic juggernaut. A one-bedroom flat in the city centre can easily set you back over €1,500 a month. Your monthly transport pass will cost more, and eating out is noticeably pricier. Salaries are higher, yes, but so is the constant pressure on your bank account.

-

Leipzig (The Affordable Challenger): Tucked away in Saxony, Leipzig is a vibrant, creative city that’s quickly gaining a stellar reputation. Here, a similar one-bedroom flat might only cost you €600-€800. Day-to-day expenses are lower across the board, from groceries to entertainment, letting you enjoy a fantastic quality of life on a much more manageable budget.

Ultimately, this choice isn’t just about saving money; it’s about what you value. Do you thrive in the high-energy, high-cost world of a major global hub, or do you prefer the comfortable, culturally rich vibe of an up-and-coming city?

Of course, your city is often tied directly to your career. For many people, landing a job comes first, and that means meeting specific criteria. If you're planning your professional move, you'll want to check out our guide on the German work visa requirements. Getting a handle on these prerequisites is a vital step in matching your career ambitions with the right city.

Breaking Down Your Housing and Utility Bills

When you start sketching out a budget for life in Germany, one line item will tower over all the others: housing. It’s the cornerstone of your entire financial plan, and getting this part right from the start makes everything else much easier to manage. The German rental system has its own quirks and vocabulary, so let's break it down to avoid any confusion.

Your first step into the rental market will introduce you to two non-negotiable terms: Kaltmiete and Warmmiete. Getting a handle on what these mean is absolutely essential.

-

Kaltmiete (Cold Rent): Think of this as the pure, base rent for the physical space. It’s the cost of the flat itself, with nothing else tacked on.

-

Warmmiete (Warm Rent): This is the figure you'll actually transfer to your landlord each month. It’s the Kaltmiete plus a bundle of extra charges called Nebenkosten.

Why does this matter so much? Because rental listings can be sneaky. An attractive price might just be the Kaltmiete. You always need to double-check if a price is "kalt" or "warm" to prevent some nasty surprises down the line.

Decoding Your Nebenkosten

So, what are these Nebenkosten (ancillary costs) that turn your "cold rent" into "warm rent"? Essentially, they are the building’s running costs, which the landlord legally passes down to the tenants. You’ll typically pay a fixed amount towards these every month, and then once a year, you’ll get a detailed breakdown called the Nebenkostenabrechnung to square things away.

The costs usually bundled into your Warmmiete include:

- Heating (Heizung)

- Water (both hot and cold)

- Waste disposal (Müllabfuhr)

- Property taxes for the building

- Building insurance and general maintenance

- Caretaker (Hausmeister) services

That annual statement will detail the building's total expenses, explain how they’re split among the residents (usually based on your flat's square metres), show what you’ve already paid, and tell you if you get a refund or need to pay a bit more.

Expenses Not Included in Your Warm Rent

Here’s where many newcomers get tripped up. It’s easy to assume that Warmmiete is the final word on your housing costs, but it’s not. Several crucial bills are entirely on you to arrange and pay for separately.

Important Note: Your Warmmiete almost never includes your personal electricity, your internet connection, or Germany’s mandatory broadcasting fee. These are all separate contracts you’ll need to sign and manage yourself.

Let’s run through these extra essentials:

- Electricity (Strom): You have to choose your own electricity provider and pay them directly. For a single person, a reasonable estimate is €40 – €70 per month.

- Internet: This is another private contract you'll need to set up. A decent high-speed plan will set you back about €30 – €50 a month.

- Broadcasting Fee (Rundfunkbeitrag): This one is unavoidable. Every single household in Germany pays a mandatory €18.36 per month to fund public broadcasting services like TV and radio. It doesn't matter if you use them or not; you have to pay.

So, let's put it all together with a quick example. Say you find a flat with a Warmmiete of €900. You need to immediately add another €90 to €140 on top of that for your own utilities. Suddenly, your real housing cost is closer to €1,000 per month. Forgetting to factor in these extras is probably the single biggest budgeting mistake people make when they first move here.

Budgeting for Food and Transportation

Once your housing is sorted, the next big pieces of your budget puzzle are food and transport. These are the day-to-day costs that keep life moving, and they're also where your personal choices can make the biggest difference to your bank balance. Knowing how to shop smart and get around efficiently is fundamental to managing your life in Germany without breaking the bank.

A single person can generally expect their monthly grocery bill to land somewhere between €200 and €400. For a family of four, that figure is more likely to be in the €600 to €800 range, or even higher. It all comes down to your habits and where you decide to fill your shopping trolley.

Navigating the German Supermarket Scene

Germany has a famously competitive grocery scene, with everything from no-frills discounters to high-end food halls. The choice you make here is one of the most powerful tools you have for controlling your food spend. It's a bit like choosing a car—you can opt for a basic, reliable model or a fully-loaded luxury version. Both will get you where you need to go, but the cost and experience are worlds apart.

Your main options typically fall into two categories:

- Discount Supermarkets: Chains like Aldi, Lidl, and Netto are masters of the game. They focus on a curated range of products, with a heavy emphasis on their own excellent house brands. This lean approach keeps their prices incredibly low, making them the first stop for most budget-savvy shoppers.

- Premium Supermarkets: Stores like Rewe and Edeka offer a much broader experience. You'll find international brands, massive fresh produce sections, and dedicated counters for meat, cheese, and baked goods. All this variety comes with a higher price tag.

A Practical Tip: Many Germans (and clever expats) take a hybrid approach. They'll do the bulk of their shopping for staples—pasta, rice, tinned goods, cleaning supplies—at a discounter. Then, they’ll pop into Rewe or a local market for specific high-quality items like fresh fish, specialty cheeses, or organic vegetables. This "best of both worlds" strategy helps you save on the basics while splurging where it counts.

The Crossroads of Transport: Public vs. Private

Getting from A to B is another major line item in your monthly budget. Germany gives you two fantastic options: world-class public transport or an excellent road network for private cars.

Making the right choice here can dramatically impact your finances. A car offers absolute freedom, but it comes with a long tail of recurring costs that go far beyond the sticker price. Public transport, on the other hand, is convenient, highly cost-effective, and—especially with recent changes—incredibly simple to use.

The True Cost of Car Ownership

The romance of the Autobahn is hard to resist, but the financial reality of owning a car in Germany is a serious commitment. Before you take the plunge, you have to look past the purchase price and consider all the hidden running costs.

Here’s a realistic breakdown of what you're signing up for:

- Fuel (Benzin/Diesel): Petrol prices in Germany are high. A single tank of fuel can easily set you back over €80, which adds up quickly if you're commuting daily.

- Insurance (Versicherung): This is mandatory and can be a significant expense, particularly for new drivers or anyone without an established German driving record.

- Vehicle Tax (KFZ-Steuer): An annual tax calculated based on your car's engine size and CO₂ emissions.

- Maintenance and Inspections: You'll need to budget for regular servicing and the mandatory technical inspection (Hauptuntersuchung, or "TÜV") every two years.

- Parking: In most cities, free parking is a myth. A dedicated parking spot can cost anywhere from €50 to over €150 per month.

When you tally it all up, the true monthly cost of running a car often climbs past €300-€400, even for a fairly modest vehicle.

Embracing Public Transport: The Smart Choice

For the vast majority of people living in or near a German city, public transport is the undisputed champion of cost and convenience. The network of buses, trams (Straßenbahn), and trains (S-Bahn and U-Bahn) is efficient, reliable, and extensive.

The Deutschlandticket has completely revolutionised travel. For a simple, flat fee of €49 per month, you gain unlimited access to all local and regional public transport across the entire country. This one ticket replaces a complicated mess of local passes and offers unbelievable value. It often costs less than what you’d spend on petrol in a single week.

Frankly, if you're serious about managing your cost of living in Germany, this ticket is a no-brainer.

Understanding German Healthcare and Social Security

When you start budgeting for your new life in Germany, it's tempting to focus only on your gross salary. But to get a real sense of your monthly budget, you have to look deeper. A sizeable chunk of your earnings will go directly into Germany’s comprehensive social security system, and that includes mandatory health insurance. Getting your head around these deductions is the single most important step to understanding your actual take-home pay and avoiding any nasty financial surprises down the line.

The entire German system is built on a foundation of solidarity, where everyone's contributions create a strong safety net for all residents. This isn’t just a nice idea—it’s a legal requirement for anyone employed in Germany. Forgetting to factor in these costs will give you a completely unrealistic picture of your disposable income.

The German Health Insurance System

Germany has a dual health insurance system, which means you have a choice between public and private plans. For most people, however, the choice is already made for them.

- Public Health Insurance (Gesetzliche Krankenversicherung – GKV): This is the standard for the vast majority of employees. The cost is calculated as a percentage of your gross salary, and your employer pays half of it. It’s a straightforward and very common setup.

- Private Health Insurance (Private Krankenversicherung – PKV): This becomes an option only if you're a high earner (currently making over €69,300 per year), a civil servant, or self-employed. Unlike the public system, your premiums here are based on your age and health profile, not your income.

For most people moving to Germany for work, the public system (GKV) is what you'll be dealing with. It provides excellent, comprehensive medical coverage for you and even covers your non-working dependents under the same plan.

Germany's average gross annual salary sits around €54,000, which works out to about €4,500 gross per month. Your statutory health insurance contribution is 14.6% of that salary, split right down the middle with your employer. You'll also pay a small additional surcharge that varies slightly by provider.

Decoding Your Payslip Deductions

Health insurance is a big part of the picture, but it’s not the only deduction you’ll see. Your German payslip will list several items that, together, make up your total social security contribution. These are all automatically withheld from your gross pay before the money ever lands in your bank account.

The main deductions you'll see are:

- Pension Insurance (Rentenversicherung): This is a significant deduction that goes towards funding the state pension you'll be entitled to later.

- Unemployment Insurance (Arbeitslosenversicherung): Your contribution to a fund that provides financial support if you ever find yourself out of a job.

- Long-Term Care Insurance (Pflegeversicherung): This covers the potential costs of nursing care you might need due to old age, an accident, or a serious illness.

All in, these contributions typically add up to around 20-22% of your gross salary. The good news? Your employer matches that amount. This mandatory framework is a cornerstone of working in Germany and a major factor in the true cost of living in Germany.

Thinking about how these financial realities connect to your career move is essential. The salary you negotiate needs to be enough to cover these deductions comfortably while still supporting the lifestyle you want. For a full picture of the professional side of things, our guide on the German work visa requirements is a must-read for planning your journey.

Planning for Leisure, Education, and Other Expenses

Your budget for living in Germany isn't just about rent and groceries. To really enjoy your time here, you need to think about the other things that make life worth living—and the miscellaneous costs that always seem to find a way into our budgets. This covers everything from a well-deserved meal out to your monthly mobile phone plan.

Getting a handle on these extra expenses gives you a much more realistic financial picture. It ensures your budget isn't just a spreadsheet exercise but a sustainable plan for your new life. After all, you're moving to Germany to live, not just to survive. Let's dig into what you can expect to pay for entertainment, education, and other bits and pieces that will shape your quality of life.

Entertainment and Lifestyle Costs

Once the essentials are covered, it's time for the fun stuff. Germany has something for everyone, but costs can really swing depending on where you are. Grabbing a simple meal at an inexpensive restaurant will likely cost you about €14, whereas a nicer three-course dinner for two at a mid-range place is closer to €65.

Here's a quick look at other common lifestyle costs:

- Cinema Ticket: Seeing a new international film will set you back around €12 a ticket.

- Gym Membership: A monthly pass for a fitness club typically averages €34.

- Mobile Phone Plan: Expect to pay between €25 and €30 per month for a standard plan with calls and data.

These seemingly small costs can add up quickly, so it’s smart to keep an eye on them. For a single person, setting aside €150 to €300 per month for all these miscellaneous and leisure activities is a pretty realistic starting point.

Education and Childcare Expenses

If you're moving with family, education and childcare will be a huge part of your financial planning. The good news? Germany is famous for its high-quality public education system, which is largely free. From primary school right up to university, state-run schools and universities generally don't charge tuition fees for residents. It's a massive financial relief for many families.

While public universities are tuition-free for most degrees, you'll still need to pay a mandatory semester fee (Semesterbeitrag). This fee, usually between €150 and €300, covers administrative costs but often includes a public transport pass for the entire semester—an incredible value.

Early childhood education, however, is a different ball game. Childcare centres, known as a Kita (Kindertagesstätte), aren't always free. The costs can vary wildly depending on the state and even the city you live in. Some regions have made them free or offer heavy subsidies, but in other areas, parents might face bills of several hundred euros per child each month. If you have young children, researching local Kita costs is an absolutely critical step in your budgeting.

Of course, private international schools are another option, but be prepared for significant annual fees that often start at €11,000 and go up from there.

Common Questions About German Living Costs

Moving to a new country always comes with a lot of questions, especially about money. To help clear things up, we've put together answers to some of the most common queries we get about the cost of living in Germany.

What Is a Good Salary to Live Comfortably in Germany?

For a single person looking to live comfortably, a good benchmark is a net monthly income of around €2,500 to €3,000. This should comfortably cover all your essentials—rent, bills, food, transport, and health insurance—with enough left over for savings, hobbies, and the occasional unexpected expense.

Of course, what "comfortable" means really depends on where you plant your roots. A salary that feels generous in a city like Leipzig could feel stretched in a major hub like Munich or Frankfurt, where rents are notoriously high. For families, this number naturally increases based on your household size and lifestyle choices.

Can I Live on 1500 Euros a Month in Germany?

Making ends meet on €1,500 a month is possible, but it won't be easy. It demands a very disciplined and frugal approach to spending, and it’s a lifestyle more suited to Germany’s affordable eastern cities. You'd likely need to live in a shared flat (a Wohngemeinschaft or WG), cook nearly all your meals, and get around by bike or public transport.

In expensive cities like Berlin, Hamburg, or Munich, a €1,500 monthly budget is simply not realistic for most. The high cost of rent alone would swallow up a huge chunk of your income, leaving very little room for anything else.

Which German City Has the Lowest Cost of Living?

As a rule of thumb, cities in the eastern part of Germany tend to be significantly more affordable than those in the west and south. Cities like Leipzig, Dresden, and Halle (Saale) are consistently named among the country's most budget-friendly urban centres.

These cities offer an incredible quality of life, complete with rich culture and great public services, but at a fraction of the daily cost you'd find in places like Munich, Stuttgart, or Frankfurt.

How Much Are Monthly Groceries in Germany?

A single person can expect their monthly grocery bill to land somewhere between €200 and €400. This figure really boils down to your diet and, most importantly, where you shop. Shopping at discount supermarkets like Aldi and Lidl is the single best strategy for keeping food costs low. For a family of four, it's wise to budget at least €600 to €800 per month for groceries.

For more in-depth articles on life in Germany, you can explore the various topics covered on our iknowly blog.

Feeling a bit overwhelmed by the details of moving to Germany? The experts at iknowly are here to help. We can connect you with verified German professionals for 1:1 consultations on everything from visa paperwork to career advice. Get the personalised guidance you need for a smooth and successful move by visiting https://www.iknowly.com.

Leave a Reply